How do customers react to price changes? The indicator price elasticity records the effects in figures. You can read exactly how here.

When prices go up, sales go down, when prices go down, sales go up. What sounds so logical is somewhat more complicated in practice. The extent to which this simple formula applies depends, among other things, on price elasticity. Background knowledge on this parameter also helps with your own pricing.

Table of contents

- What is price elasticity?

- Distinguishing between price elasticity in supply and demand

- How is price elasticity calculated?

- How is price elasticity used?

Price elasticity – definition

Direct price elasticity is, according to Gabler Wirtschaftslexikon the “ratio that measures the relationship between the relative change in demand for a good and the relative change in the price of the same good that triggers it (and in this respect, in contrast to cross-price elasticity, directly).”

A cross-price elasticity, on the other hand, means, according to Gabler, the “measure of the percentage change in sales of one good in the case of a price change of another good. In the case of a strong substitution relationship between two products, there is typically a (strongly) positive cross-price elasticity, i.e. the price reduction of one product entails a decline in sales of a similar product […]”.

In simpler terms, “direct price elasticity” refers in each case to a single good whose price is changed. The “cross-price elasticity” shows how the price change of one product affects another product whose price has remained the same. The following applies to both: The more the purchasing behaviour changes, the higher the price elasticity.

Between supply and demand

Not only consumers, but also suppliers react to changing market prices. Therefore, we speak of both price elasticity of demand and price elasticity of supply.

Price elasticity of demand

In the case of demand-price elasticity, which is much more of a topic than that of supply, we examine how consumers react to changing prices. In principle, a price increase causes demand to fall. A price reduction increases demand. In this case, the direct price elasticity shows us by how many percent the demand for the good in question changes.

If we determine a value of more than 1, the demand for this good is elastic. If the value is less than 1, the demand is inelastic. This means that the price changes more than the demand. Consumers therefore react little or not at all in their purchasing behaviour to a price change. Typically, this is the case with basic foodstuffs and other essential goods. However, exceptions can occur, as the Giffen paradox (see box) shows. One speaks of perfectly inelastic when the determined value is zero.

The Giffen Paradox

The paradox of the Giffen case is that consumers react differently to a price change than seems logical. In the lifetime of the Scottish economist Robert Giffen during the 19th century, higher bread prices caused poor people to buy more bread than before.

The reason is that the precarious workers could no longer afford complementary more expensive foods such as milk and meat due to the price increase. Since they practically only lived on bread, the demand for it increased despite the higher price. Bread is therefore one of the so-called Giffen goods.

Robert Giffen was long considered the originator of the description of this behaviour. This has since been challenged, but the paradox remains associated with his name.

In addition to the direct price elasticity mentioned above, indirect price elasticity or cross-price elasticity also affects demand. Here we are dealing with a change in the price of another good that affects our own product. In this context, we speak of complementary goods that complement our good and substitute goods that replace our good.

The effect is usually as follows: If the price falls, the demand for this good increases and at the same time that for such goods that complement it. Example: A price reduction for shoes will not only boost their sales, but also those for shoelaces, shoe polish, brushes and shoe trees.

Conversely, a price increase will only increase the demand for substitute goods, i.e. competing products. The extent to which cross-price elasticity comes into play depends strongly on the availability of the complementary and substitute goods.

Price elasticity of supply

This is about how supply responds to changes in market prices. Price elasticity shows the relationship between price and supply developments. Normally, when the price of a certain good increases, the supply of that good also increases, and when the price decreases, the supply decreases accordingly.

Here, too, 1 is the magic number. If the value is below this, we are dealing with inelastic supply, above this with elastic supply. So if the supply is inelastic, suppliers hardly react to changes in the price.

The reaction also depends on how much capacity is utilised. When capacity is fully utilised, for example, production cannot be ramped up at short notice. If suppliers do not react at all, we speak of a completely inelastic supply. In addition, strategic considerations may also underlie this.

Calculate price elasticity

As mentioned, a value of more than 1 indicates high price elasticity and a value of less than 1 indicates low price elasticity. We calculate this ratio by dividing the percentage change in demand by the percentage change in price.

Price elasticity formula

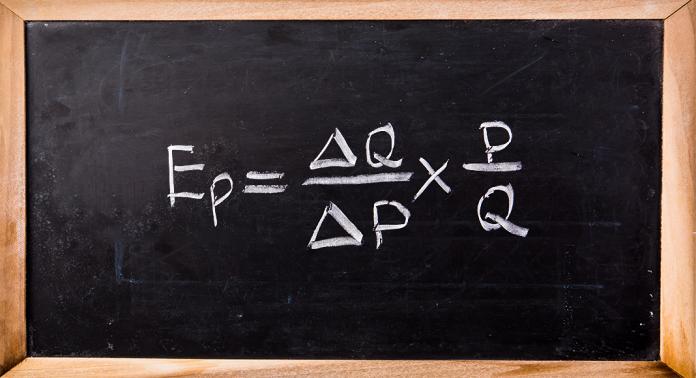

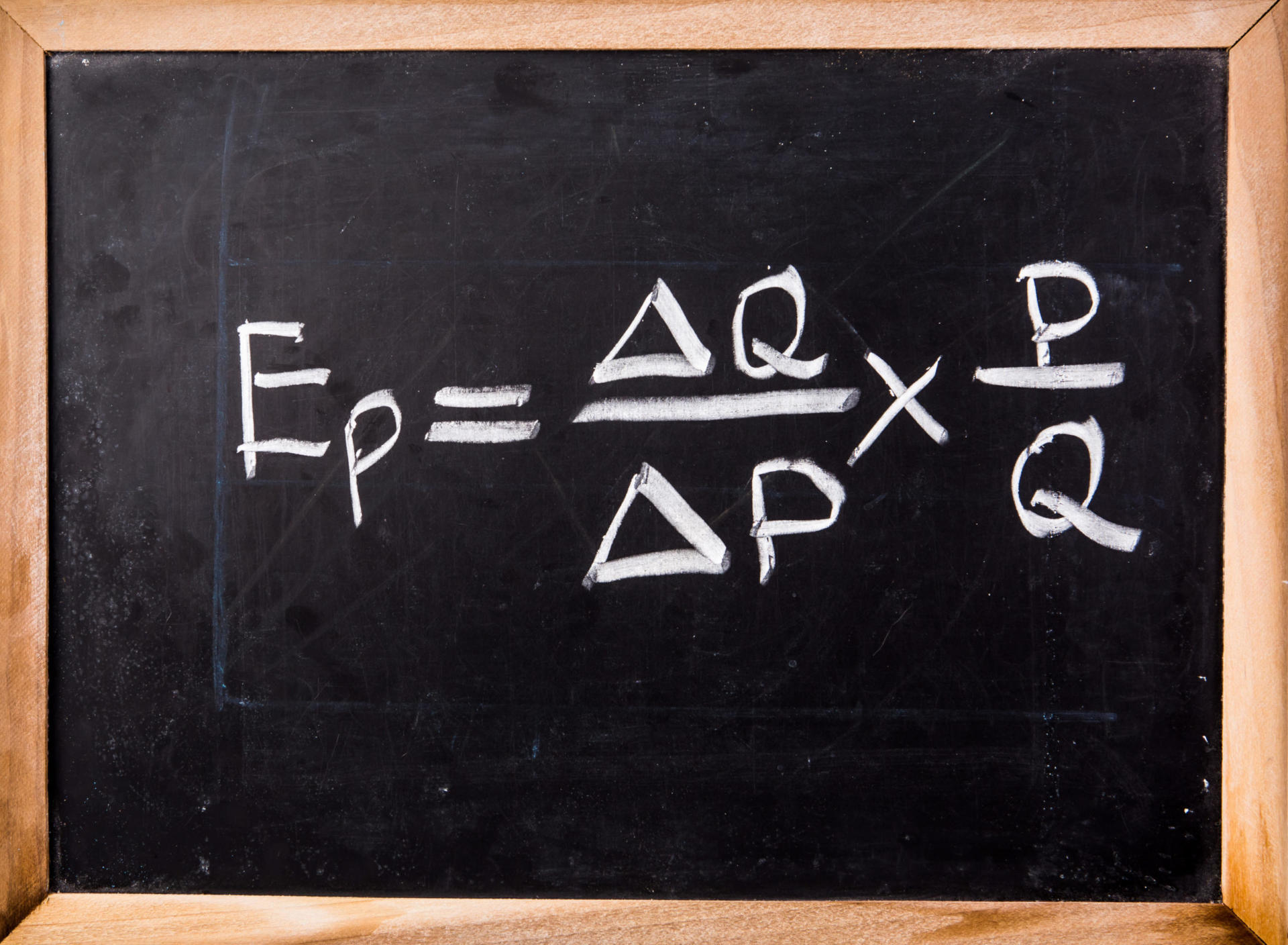

The simplest formula to calculate the price elasticity of demand looks like the figure.

- E = elasticity

- p = price

- Q = quantity demanded or supplied

- Δ = percentage change

Δp calculate by subtracting the original price from the new price.

ΔQ is calculated by subtracting the original quantity from the new quantity.

The second division contains the original price and quantity.

Price elasticity – examples

Suppose we sell towels for €3 each. Of these, 300 went over the counter each month. After a price increase to 5 €, only 200 are sold. Then the calculation for elasticity looks like this:

((300 – 200) : (5 – 3)) x (3 : 300) = 0.5.

The value is well below 1, which means that demand is inelastic. The price therefore changes more than the quantity. Thus, the price does not affect sales as much. If we assume that the quantity sold is reduced to 100 by the price increase, we reach a value of 1. If the quantity falls even further, demand is elastic.

Use in practice

Every entrepreneur who pursues a strategic marketing mix as part of his price policy should be guided by price elasticity. Ideally, insights into this are already used in price formation. Of course, these are not based on the founder’s own experience, but they can be based on competitor observation and market research data.

These two points also play a role in the further course, as they always complement internal knowledge. Precise knowledge about price elasticity helps with a new strategic orientation if, for example, sales develop differently than expected. Entrepreneurs can thus estimate relatively accurately in advance how customers will react to price changes. They can thus calculate that total turnover will not be lower than before in the event of a price increase due to falling sales.

The degree of price elasticity also depends on the type of goods. In general, luxury goods have a much more price-elastic effect than everyday items that cannot be dispensed with. The greater scope for a strategic pricing policy is therefore offered by products and services that one does not necessarily need per se or at least in a premium version.

Sources: Gabler Wirtschaftslexikon (https://wirtschaftslexikon.gabler.de)

Image sources: Shutterstock